January 2026: A historic rupture in trust and money – not good for banks

January 2026: A historic rupture in trust and money – not good for banks

Unfortunately, 2026 has begun with several literal bangs. To my regular readers, it is difficult to come up with a snappy movie analogy this month because none of us have seen a movie like this before.

Instead, I share some reflections on stand out items in this rapidly evolving landscape and what they may mean for banks in what I anticipate being a volatile 2026.

1. US character test – not looking good

I am reminded of my Jan 2025 Treasury Talk column about the Star Trek episode of Kobayashi Maru, a character test. A year ago I noted that the US risked failing a character test vis-a-via its allies.

Specifically, the Administration aimed to impose tariffs on other countries, including neighbors and long-standing allies, to raise government revenue from abroad.

Fast forward, the Administration both implemented tariffs and has treated traditional US allies increasingly poorly even while engaging adversarial countries like Venezuela and Iran.

However, in 2025 US tariff rates were set so high that countries exporting to the US could not experience enough exchange rate depreciation to offset tariffs, meaning tariff costs mostly fell on US companies (lower profits) and households (higher prices). Exported goods were also redirected to other countries, contributing to disinflation and lower interest rates in other advanced economies.

Worse, recent events around President Trump’s demands that the US “acquire” Greenland lack a clear grounding in US national interests. The US can achieve its security objectives best by working more collaboratively with long-standing allies. The Administration has approached Greenland with a focus on “winning the US a deal” – but US relationships with other countries are iterative games. Recent Administration actions demonstrate:

· a hurry to advance consequential policy choices with limited explanation;

· a focus on securing perceived historical legacy;

· limited impulse control; and

· a desire to act to “settle scores,” including related to the Noble Prize which has zero to do with US national and economic security interests.

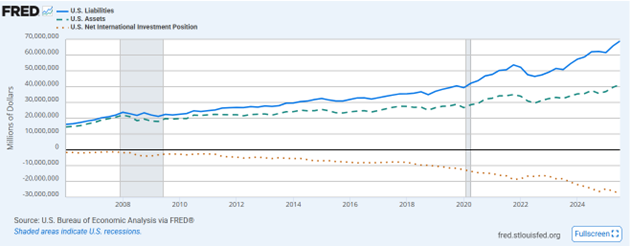

In my Jan 2025 Treasury Talk column, I noted that the counterpoint to decades of US trade/current account deficits is that foreigners have accumulated significant investments in the United States. The chart below shows the US net international investment position (NIIP) relative to GDP. The NIIP determines whether a country is a net creditor (+) or a net debtor (-). The US net international investment position – the difference between US investment holdings abroad and foreign holdings of US assets – is negative, implying the US is a large net debtor abroad, and totals about -$28 trillion, or +100% of US GDP (red dotted line).

While the NIIP is a dauntingly large number, as the graph shows, the gross amount of foreign portfolio and direct investment in the United States (US liabilities – the blue line) actually has grown more than US holdings of foreign assets. Gross foreign ownership of US assets totals $68.8 trillion or more than 2x US GDP. If foreigners decide to sell US assets, this gross amount of $68.8 trillion is relevant.

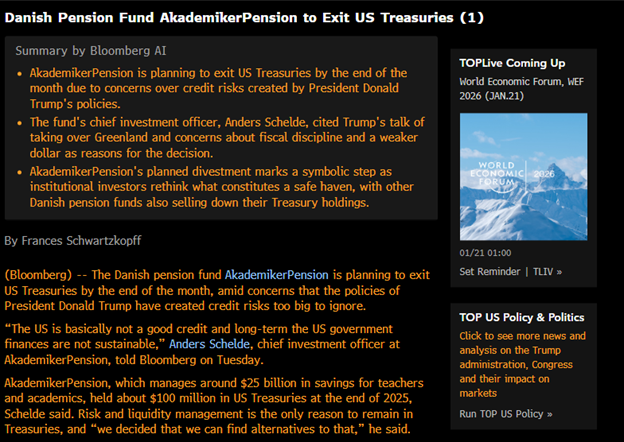

While news this week of a Danish pension funds selling US Treasuries is small in isolation, the cumulative effect of a number of negative investment decisions to “Sell America” can become consequential and occur with a bit of a lag.

While many traditional US allies still have dependencies on the US for energy and/or military assistance, the erosion in international trust in the US can be expected to weigh further on both the USD and US assets in the medium-term.

TINA (There is No Alternative) is often used as a rebuttal — where would foreign investors and foreign central banks place funds if not the US?

One asset foreign investors could buy is their own government debt as other G-7 governments in Europe and Asia need to re-arm and increased bond supply means nominal yields ex-US become more attractive.

The only thing that is needed is for institutional ESG investment mandates to meaningfully change to permit more investment in defense industries. For example, this week JPMorgan asset management announced plans to abandon the exclusion of defense sector holdings for 95 funds in Europe. It seems plausible that European and Asian asset managers will get there as well.

Trust in US economic policy and central bank credibility is what underpins any fiat currency. That trust had already weakened and has diminished further in early 2026 as reflected in strong gains in precious metals. At the same time, the passage of the Genius Act and less volatile USD stablecoin’s appropriation of the public blockchain architecture of cryptocurrencies has dented crypto’s performance.

Money is both a means of exchange and a store of value. We seem to watching the real time an accelerating erosion of confidence in the US dollar as a store of value even as the dollar remains necessary as a means of value of exchange.

As I pointed out in Congressional testimony last May, this loss of confidence is not purely international as over a number of US state legislatures, including here in Texas, have adopted legislation related to greater use of precious metals as money.

2. The narrowing of the post WWII US global security umbrella puts upward pressure on G-7 government bond yields, including the US

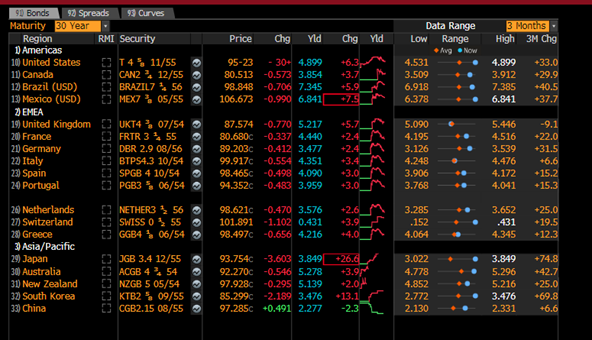

The shock that occurred this week in Japan’s government bond markets reflects Japan’s plan to boost government spending. Like many other countries in G-7, Japan needs to increase its defense spending given the US withdrawal from providing a reliable global security umbrella even as its faces significant government debt and demographic challenges.

On Tues (Jan 20), 30-year JGB yields rose a stunning 27 bps to 3.85%, pressuring other G-7 sovereign yields higher. This process of global advanced economy bond market repricing should be anticipated to continue as European countries recognize the need to increase collective spending to fund their own defense and other long-standing US allies, like Canada and South Korea also increase their military spending.

However, the process of shifting the G-7 defense umbrella from a US-centric model to a distributed model implies more debt issuance from countries facing already high debt burdens and aging demographics structurally. Thus, a significant increase in government bond issuance implies a rise in government bond yields.

Japan’s situation is also indicative of where continued use of expansionary fiscal policy will lead other advanced economies. Specifically, it will lead the central bank to the choice of saving its bond market from rising yields through yield curve control policies (YCC) or permitting inflation to remain above target and accept currency depreciation. Unlike the US, Japan has significant investments overseas, most notably in the US, and could repatriate those assets to reduce pressures on the yen.

Steepening yield curves in other advanced economies can be expected to put upward pressure on long-dated US Treasury yields. Under a new Fed Chair, will the Fed act later this year through QE to cap out a rise in long-dated Treasury yields? If so, it will weaken the USD/further strengthen precious metals and the currencies of countries that have maintained more fiscally conservative policies and have lower government debt burdens.

3. The US macro-outlook; US precious metal exports may overstate Q4 growth; H1 26 fiscal stimulus a growth tailwind; investment a headwind.

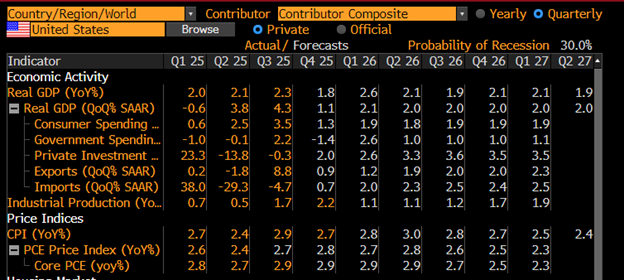

Data as of Jan 18 above show consensus market expectations are for Q4 GDP growth to decelerate, followed by a pop in Q1 as OBBBA-related tax refunds filter through to US consumer spending.

I agree with the consensus’ view on OBBBA refund upside pop in H1 US GDP. However, before we get to 2026, I believe that are some misreads that are coming out of the Atlanta Fed’s GDPNow data and also will come out of Q4 US GDP print (due end February). Specifically, these misreads to the upside are related to how US precious metal exports find reflection in these data. You can read more about the topic here on my Substack – “Is Atlanta Fed GDPNow Broken Again?”. This is relevant as Secretary Bessent cited the AtlantaFed’s Nowcast in his remarks in Davos this wek.

Bottom line is that both the AtlantaFed USGDP Nowcast and even Q4 US GDP data risk coming in misleadingly hot due to elevated US exports of precious metals which are primarily investment flows. Banks need to consider what these US data misreads may mean for their models, interest rate risk and balance sheet management.

Looking further out to 2026, the clear theme of the Administration’s second year is to try to run the US economy hot into the mid-term elections in November.

· OBBBA tax cuts due in 2025 were structured to come in H1 2026 as refunds due to delayed IRS publication of tax tables. The operating assumption is that most of these refunds will be spent by US consumers but, in the interim, tax refunds will support retail deposit growth.

· On fiscal policy, on Jan 7, President Trump made a statement on Truth Social about seeking an increase in the 2027 US military budget from $1 trillion to $1.5 trillion, a 50% increase. If this moves forward, expansionary US fiscal policy appears poised to continue beyond H1 2026.

· Policy proposals to try to ignite more activity in US housing could broaden and deepen the US economic expansion beyond fiscal policy. A number of proposals have been put forward and another proposal related to young Americans’ 401K assets appears likely to be put forward this week. However, so far ineffective US housing affordability policies have been proposed. While the Fed’s large Covid QE pulled forward years of US home appreciation and effectively froze the existing US home sales market, more recently tariffs and US immigration restrictions have raised the cost of new US home construction. As can be seen below, residential fixed investment (hot pink) has become a drag on US economic growth. More home supply/lower existing home prices or higher wages for younger Americans are the only effective solutions.

· A risk factor to the “run-it-hot” H1 2026 US growth outlook is evident also in the chart above – specifically the orange bar showing the decline in non-housing private investment since the start of the Administration. US businesses appear to be sitting increasingly on the sidelines with regards to investment given erratic policies coming out of the White House.

· The expectation at Davos is that the mid-term “affordability drive” will translate into new US edicts on US businesses related to credit card fees, housing, energy, etc. Bluntly, the Administration’s willingness to tell US companies how to run themselves is not what an innovative market-oriented economy looks like, much less a society that values personal liberty. On a related note, I take exception to masked, heavily armed ICE agents’ use of deadly force in US residential communities and note that most Americans do not support this. The sharp criticism of US CEOs (recently, Darren Woods – Exxon on Venezuela being uninvestable; Jamie Dimon – JPM on legal case against Jerome Powell) who raise objections to the Administration also does not instill business confidence.

· What will happen after the mid-terms? It is hard to say, but US companies understandably may wait to see before they invest, weighing on banks’ commercial lending.

4. Inflation derivatives are priced for a rise in US inflation to show up on the scene in 4-5 months time; my baseline is inflation 3%+ in 2026

CPI swaps signal inflation will rise in 4-5 months time, but still look for inflation to remain below 3%.

However, the inflation swap market likely underprices inflation risks. The impact of the US government shutdown in Q4 on US CPI data has tarnished some investors’ perceptions of the reliability of US inflation trading markets. For example, Polymarket places the risk of another US CPI delay at above 36% before 2027.

![]()

Big picture 2026 US CPI prints above 3% are my baseline given the combo of delayed US tariff impacts, US fiscal and monetary ease, a tighter labor market due to changes in immigration policy, and long-run US inflation expectations that are moving upwards based on US consumers’ lived experiences of price pressures on key goods and services (groceries, electricity, healthcare).

A simple rule of thumb is that when inflation remains above target, easing fiscal and monetary policy simultaneously outside of a recession will just keep inflation going.

5. Treasury Secretary Bessent’s influence dims as a sanifying force

To many in financial markets, Treasury Secretary Bessent has been viewed as a sanifying force in the Administration. However, it now appears that Treasury Secretary Bessent’s sphere of influence is far narrower than previously believed. Proposals for large increases in defense spending, ineffective housing policy proposals, blowups over Greenland look to have spun somewhat outside of his span of control.

Recent legal action against Chair Powell reportedly also was taken without his knowledge. While Congress has rallied in support of an independent Fed, Bessent now appears a bit left behind in the discussion around next Fed Chair. But wasn’t Fed reform supposed to be Secretary Bessent’s key issue?

Certainly, the White House could direct the Department of Justice to pull back on its legal fight with Chair Powell – but it hasn’t. Rather, Secretary Bessent broadened the Administration’s attack on Chair Powell into more substantive territory than Eccles building cost overruns in his Davos speech on Tuesday, drawing renewed attention as to Covid-related insider trading.

It can be true that:

· the Administration is applying extraordinary pressure on Fed officials to lower interest rates which is inappropriate; and

· Fed Chair Powell has made both past ethical and policy mistakes.

Big picture – Chair Powell’s term as Fed Chair will be over in May, but it appears that Bessent’s influence on US economic policy is weaker than previously understood. This development also weakens confidence in US economic policy.

6. Kevin Warsh as next Fed Chair?

As I talked about in December, it seems plausible that Kevin Warsh will be the next Fed Chair soon. Betting markets appear to agree. Among the short list of candidates, he is the best positioned to carry forward both Fed independence and Fed reform and navigate the Administration’s complexities.

But can a Fed Chair alone affect meaningful economic policy change without sound fiscal policy and Congressional political back-up? Probably not. For this reason, it is important not to attach too much importance to any single policymaker – even the Fed Chair — as a solution to US economic policy challenges. Some in markets have done with Treasury Secretary Bessent and should learn.

7. What does this mean for banks?

o Events this week demonstrated when the Administration senses broad dissatisfaction (military action re: Greenland) that they do backtrack. By contrast, when individuals speak up about Administration policies they find themselves targeted (Dimon – new lawsuit, Moynihan — Davos dinner disinvite). These recent events offer an important lesson to US banks as they react to the Administration’s ill-thought out approach to capping credit card interest rates for a year. Collectively banks can push back on the proposal, but it is difficult to stand up to the Administration individually. Most reasonable observers would agree that this proposal should be subject to an economic impact analysis as it risks reducing credit availability to US subprime borrowers. While many US banks are not active in credit card lending, failure to act collectively on this issue may lay the groundwork for other ill-conceived banking policy initiatives in the future.

o Discussions of reducing the Fed’s expenditure on paying banks interest on reserves may reemerge in the Fed’s leadership transition as a device to enable more government spending, including on defense.

o Standing repo facility and discount window usage has come down as US banking system reserve balances have expanded to $3.04 trillion, well in excess of levels where SVB failed. The Fed’s reserve management purchases are working. However, a risk scenario to watch for as we move forward is foreign banks hoarding USD reserves at the Fed out of concern about dollar swap lines with foreign central banks being curtailed under the next Fed Chair.

o US bank earnings releases showed that volatile financial markets benefited banks with FICC and capital market businesses while more Main Street-oriented lending-oriented business lines saw more muted earnings. US economic policy uncertainty is likely to constrain fixed investment at least until the mid-term elections are over.

o My base case remains inflation rises and stays above target in 2026 and results in higher long-term US interest rates and a steeper Treasury curve. US fiscal and monetary policy have both been eased while the economy was not in recession and labor supply is tight, implying higher inflation is coming. Repricing in other G-7 government bond markets due to increased defense spending will also pressure US Treasury yields higher. Finally, increased USG military spending and loose fiscal policy will maintain upward long-dated yield pressure.

o Foreign investors may be less eager to bank with US institutions as risk of “capital wars” rise. US banks with high foreign exposures may find themselves negatively impacted.

o The dollar’s reserve currency status will continue to wane as the US security umbrella shrinks. I anticipate a further weakening of the US dollar in 2026. US banks would do well to consider offering fx-denominated deposits and offerings to custody precious metals, as I recommended multiple times last year.

o My views on USD stablecoin and banks remain negative and are explained in a 2025 podcast with Hedge Fund Research here.

I hope readers are able to join for our series of upcoming February BTRM webinars (Feb 5, 12 and 19) with the major rating agencies regarding how they rate banks.

I will be speaking at the CeFPro Treasury & ALM conference March 10-11 n NYC on the debasement trade and what it means for banks. You can register here Event Homepage – Treasury & ALM USA

I also will be giving a keynote in Mexico City at an event hosted by GARP in March 2026. I look forward to seeing some BTRM, Treasury Talk readers and banking friends at these virtual and live events.

I also will be giving a keynote in Mexico City at an event hosted by GARP in March 2026. I look forward to seeing some BTRM, Treasury Talk readers and banking friends at these virtual and live events.