Why the BTRM?

Your BTRM Journey

The Certificate of Bank Treasury Risk Management (BTRM) is a six-month, part-time course designed to empower individuals working in, or intending to work in, every aspect of bank balance sheet management and asset-liability management (ALM). The BTRM is unique in being the only professional qualification for bank Treasury, Finance and Risk professionals that covers every aspect of bank ALM, capital and liquidity risk management. The strong emphasis of the course throughout is on practical relevance and equipping students with the tools and techniques required by banks in the real world. The BTRM is a career-enhancing professional qualification.

Asset-liability management is the core discipline in banking, and one that must be mastered by every bank, irrespective of its operating model or product suite. The post-crash Basel III environment emphasises a strong adherence to conservative principles of capital and liquidity management – the traditional role of the Treasury function in a bank. Obtaining the BTRM provides students not only with a recognised professional qualification demonstrating excellence in the Treasury space, it is also a sign of genuine commitment to excellence in risk management.

BTRM is practitioner led, developed and orientated, and enables students to acquire an advanced-level understanding on the core process of bank ALM governance. Practitioners will be able to apply best-practice techniques to measure ALM risks and formulate strategies for management of these risks at their employing institutions.

Benefits

The BTRM has partnered with University of Northwestern Switzerland (FHNW) to offer the programme jointly

Our partnership with the FHNW means all students are awarded the BTRM certificate and also a Certificate of Advanced Studies (CAS) from a prestigious European University, now badged as the International Double Degree BTRM and CAS Bank Treasury Risk Management.

We are delighted to announce that the BTRM is now fully accredited by the Association of Corporate Treasurers.

A significant criteria for their choice was the practical application of the BTRM programme for those working in treasury, ALM, balance sheet management and risk positions in banking, as well as those focusing on transfer pricing and risk in consultancy firms.

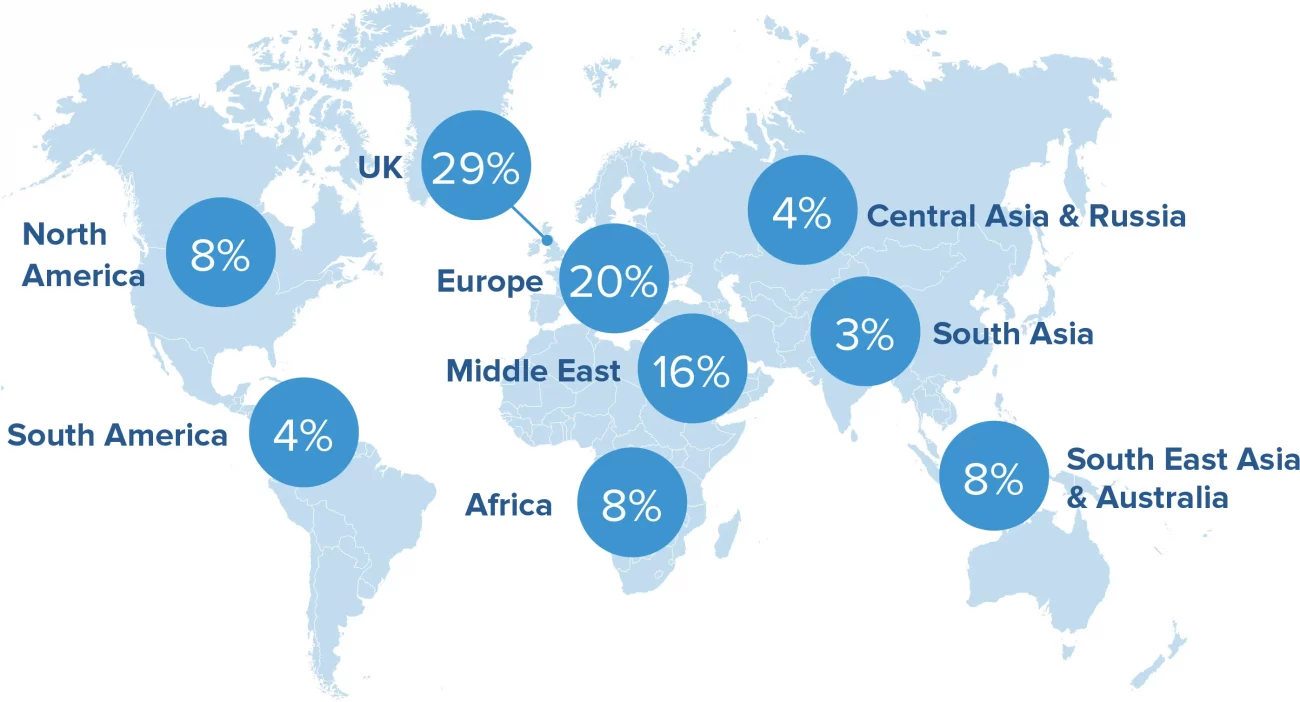

Qualify from anywhere in the world

Six-month part-time global programme delivered twice a year. All lectures streamed live over the Internet and recorded. Lectures can be viewed at any time. Study while working: career-enhancing qualification that can be taken worldwide.

Practitioner orientated

BTRM delivers learning of practical value, developed and taught by highly experienced practitioners

Expert teaching and support

Our Faculty is an acclaimed team of instructors combining respected academics and renowned practitioners, all specialists in the field of bank ALM and Treasury risk management

Lifelong learning

Alumni benefit from continuous education in the form of webinars and thought leadership articles.

At the BTRM we make Lifelong learning simple. At any point going forward all Alumni can access the next cohort. You will be able to join the new lectures live with the current crop of students.