Moorad Choudhry (August 2025)

BTRM Faculty Opinion

The Gap Between Theory And Practice Was Too Big – So We Closed It – Professor Moorad Choudhry, BTRM Founder

It seems that these days, milestones in our industry follow a familiar script: a LinkedIn post, a few superlatives, and a round of applause. After over a decade building a qualification born from a gap that no-one appeared to have identified, we’ve noticed how easy it is to confuse visibility with progress. The real test isn’t whether a concept looks good on paper; it’s whether it survives contact with the real world.

In theory, there is no difference between theory and practice – but in practice, there is! (Attributed to Albert Einstein but apparently apocryphal 😁). What I do know is that in banking and finance, in the middle of a market crisis no one reaches for a textbook.

When we launched the BTRM in 2014, we were addressing a gap in financial markets professional education, namely the one on How To Manage A Bank’s Balance Sheet So That It Is Always Long-Term Survivable and Robust. Yes, the bank Treasury space. How come there was no course specifically addressing that? Partly because Treasury was traditionally the department that no-one in other departments really spoke much about. Back in the da,y there were never that many conferences on the topi,c and I don’t remember seeing loads of publications from consultants talking about it.

(I remember a time shortly after joining KBC Financial Products in 2003 and the legendary Jan de Spiegeleer telling me he was surprised someone like me came from Treasury – he meant it as a compliment 😁).

I first tried to set up a BTRM back in 2006, but pre-GFC no-one wanted to know.

After the 2008 crash, the picture changed.

What was our driver post-GFC?

Following many years in banking, we’d seen the same issue many times: professionals being offered education that was theoretical, abstract, and disconnected from the vital , practical problems treasury teams and balance sheet managers face every day.

This mattered – matters – because in banking, the balance sheet is everything. We’d seen it with our own eyes. We’ve seen the pressure of the trading floor, the uncertainty of volatile markets, and the weight of managing the conflicting requirements of borrowers (assets) and savers (liabilities). And we’d seen a lot of good people go into those environments without the tools they would need. That gap between theory and practical action isn’t academic – it’s stressful, and at times, dangerous.

So we built the BTRM with one goal: to close that gap. To strip away the unnecessary complexity and deliver education rooted in practical application. To teach people what actually works – in the bank, in the treasury department, under conditions of both certainty and uncertainty.

This matters because better Treasury education doesn’t just make better treasurers. It makes stronger banks, more resilient systems, and ultimately a more stable financial world. #dogoodwork.

What you learn Wednesday, you apply Thursday

An early BTRM Cohort graduate, James Hassell of Santander, summed it up perfectly: “I really liked the way that one would learn something at a lecture and then go back to the office and apply it next day to the day job. It was that practical and relevant a course for practitioners.”

Very gratifying, because that’s exactly what we’d intended!

We designed the BTRM for busy professionals who need tools that are relevant to their balance sheet and that they can use today, not tomorrow. You won’t find textbook hypotheticals here. What you will find are techniques you can take straight back to your desk – whether you’re recalibrating liquidity buffers, building a capital management plan, trying to estimate the “term liquidity premium” or defending your ALM strategy to the regulator. Or all of these things.

BTRM students don’t study theory. They stress-test it in live roles, across functions, teams, and geographies.

Where practitioners help you shift from knowing to doing

Every one of our Faculty members has been in your shoes (not literally! 😀). They’ve handled balance sheets in the middle of a market crisis, worked through regulatory reviews, and defended risk decisions at the board level.

One of our instructors once said, “We’re not just teaching students. We’re equipping peers.”

The BTRM also routinely hosts ad hoc webinars with respected industry practitioners – seasoned professionals who’ve been in the trenches. Some of our recent efforts were presented by:

- Susan C. Keating, Chief Partnership Officer of the Board Risk Committee (formerly CEO of Women Corporate Directors and of the National Foundation for Credit Counseling, CEO of Allfirst Financial Bank, who successfully led it out of a rogue trader scandal s and who helped shape Dodd-Frank), on “Risk Management in Uncertain and Changing Times”

- Thomas Abraham, an experienced ALM advisor, and Ethan Heisler, Editor-in-Chief of The Bank Treasury Newsletter, with a career spanning fixed income, bond research, and bank supervision, on their two-part series “Bank Balance Sheets – This Time Is Different”

The value of these expert-led sessions is consistently reflected in alumni feedback:

“The most important gain for me was to benchmark my thinking with top-tier faculty… The BTRM is shaping how banks think.“

— Carlos Vallebueno, Corporate Treasurer, Banamex-Citi

From Canary Wharf to Zurich via Santiago and Singapore: A global network

It’s one thing to earn a certificate. It’s another to become part of a global movement that’s redefining the Treasury profession.

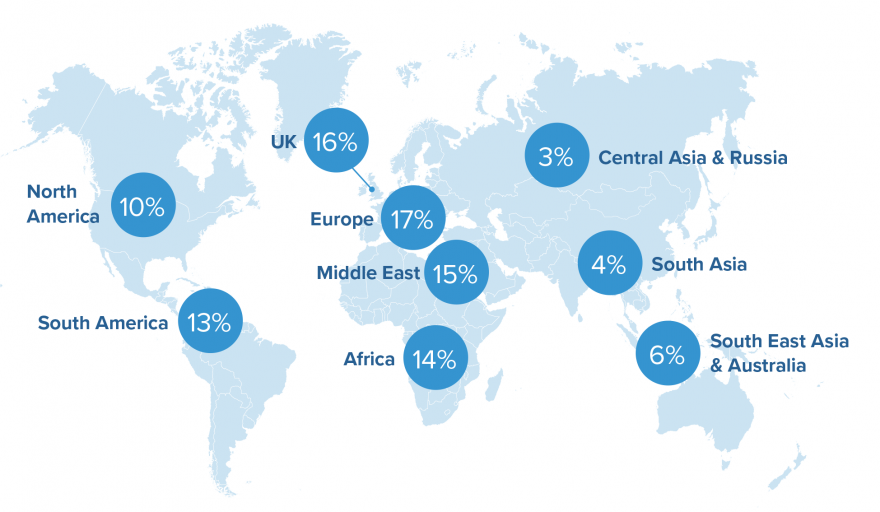

Today, BTRM alumni span over 70 countries and a wide range of financial institutions. That network grows with every cohort.

Why does this matter?

Because your network is your leverage. Our alumni share insights, collaborate on research, and sometimes even help influence regulatory frameworks.

Community matters as much as the course

Some qualifications expire the day you hang the certificate on the wall.

Not this one.

We built the BTRM to adapt with the industry and with your career. Every alumnus is welcomed back to join every new live cohort, all included when you first enrolled.

In a world where regulation is updated frequently, lifelong access means you’re never left behind. You’re always part of the conversation, always updated with the latest thinking across global bank risk management.

One of our graduates put it in more flowery terms: “The BTRM isn’t a course. It’s an ecosystem.” (That person is far too kind, though!).

Credibility opens doors

From 2021, the BTRM has partnered with the University of North-Western Switzerland (FHNW). So every BTRM graduate now receives not one, but two prestigious credentials: the BTRM and a Certificate of Advanced Studies (CAS) from FHNW.

This credibility helps open doors; whether you’re applying for a role in London, Lisbon, Santiago, or Singapore, employers look for more than experience. They look for signals, and high-quality certification is a strong signal.

It says: “I’ve been trained by the best, and I’m ready to lead.”

The moment it all clicks

Over the years, I’ve spoken to dozens of alumni who tell me the same thing: that the BTRM didn’t just boost their confidence and technical knowledge base, it reshaped their careers.

Some walked into promotion interviews and were able to discuss frameworks they’d learned just a week earlier. Others landed roles they thought were years out of reach. And nearly all of them described the same turning point: that moment when theory gave way to clarity, confidence, and control.

We didn’t build the BTRM to help tick boxes or to say a hundred words when ten will do.

We built it for professionals who want to do more than keep up. They wish to be on top of their brief, to have a genuine understanding of how a bank balance sheet works and how they can help keep it safe.

It’s worth saying again, as my old boss at RBS Group Treasury used to say: “The balance sheet is everything!”.

He was spot on 100%.

The BTRM by numbers

Spanning six months and delivered part-time, the BTRM supports practitioners across Treasury, Finance, Risk, and the Business Lines to master asset-liability management, capital, and liquidity risk. From 18 students in Cohort 1 to 105 in Cohort 21, that’s 483% growth, driven by reputation, relevance, and results.

“The programme includes valuable real-world Treasury examples… a super useful and practical reference tool.“

— Carson Tavares, Ernst & Young LLP

Students join from across the globe and stay connected long after.

“It’s encouraging to know the BTRM faculty is still there for us,” says Sidney Lidede from the Nairobi Securities Exchange.

If your role touches bank balance sheets, Finance, Treasury, Risk, or ALM, this is your programme.

“Head and shoulders above any other qualification in the City.“

— Dan Cunningham, former Head of EUR Cash, KBC Bank

(He meant “City” as a term synonymous with the global banking industry 😁)

Onwards and upwards!

Professor Moorad Choudhry